Ivory’s Economic Outlook

Below is a list of our latest Newsletters. I hope you find them interesting and informative as we provide a perspective of our Economic Outlook….. Ivory’s Economic Outlook! To receive monthly updates, please use the button below to sign up for our mailing list.

HAPPINESS ISN’T A STATE, IT’S A SKILL. IT’S THE SKILL OF KNOWING HOW TO TAKE WHAT LIFE THROES YOUR WAY AND MAKE THE MOST OF IT

–

Gary Null, Author, Alternative Medicine Advocate (Winter 2024 Newsletter)

On a recent visit to my father’s memory care center in Florida the attendants had arranged the patients into a circle for them to hit a balloon. If you’ve ever been inside the sales office of one of these facilities you probably recognize the balloon toss, or some other activity, from the brochure they use to sell their services to exhausted and sometimes defeated families who can no longer care for their loved ones at home.

GIVE A MAN A FISH AND HE WILL EAT FOR A DAY. TEACH HIM HOW TO FISH, AND HE WILL SIT IN A BOAT AND DRINK BEER ALL DAY

–

George Carlin, Comedian (Fall 2023 Newsletter)

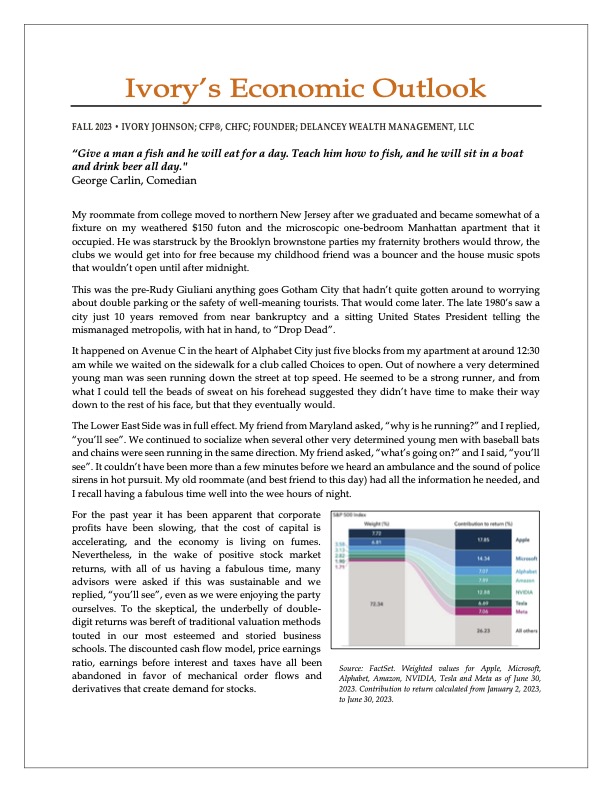

My roommate from college moved to northern New Jersey after we graduated and became somewhat of a fixture on my weathered $150 futon and the microscopic one-bedroom Manhattan apartment that it occupied. He was starstruck by the Brooklyn brownstone parties my fraternity brothers would throw, the clubs we would get into for free because my childhood friend was a bouncer and the house music spots that wouldn’t open until after midnight.

THE PROPENSITY TO SWINDLE GROWS PARALLEL WITH

THE PROPENSITY TO SPECULATE DURING A BOOM

– Charles P Kindleberger, Economic Historian (Spring 2023 Newsletter)

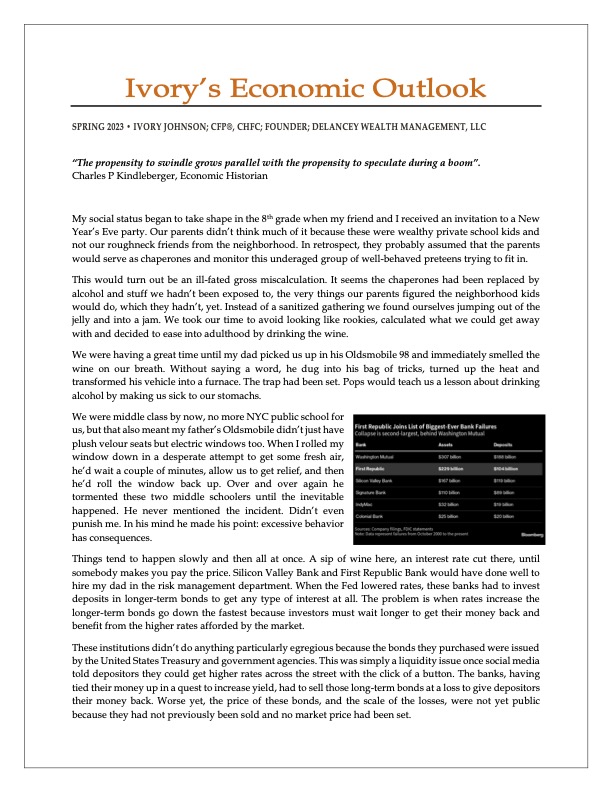

Suffice it to say these are uncertain times and investors are uncharacteristically bearish. They’ll have to be patient though; macroeconomic realities often take their sweet time to materialize.

I MAY BE A SENIOR, BUT SO WHAT? I’M STILL HOT

– Betty White, Entertainer (Winter 2023 Newsletter)

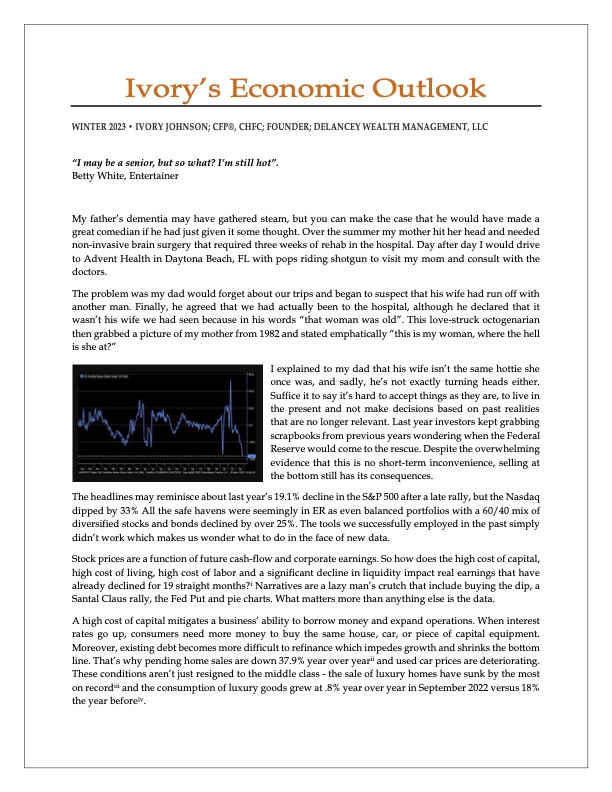

Stock prices are a function of future cash-flow and corporate earnings. So how does the high cost of capital, high cost of living, high cost of labor and a significant decline in liquidity impact real earnings that have already declined for 19 straight months?

THE FOOL DOTH THINK HE IS WISE, BUT THE WISE MAN KNOWS HIMSELF TO BE A FOOL.

– William Shakespeare, Playwright (Fall 2022 Newsletter)

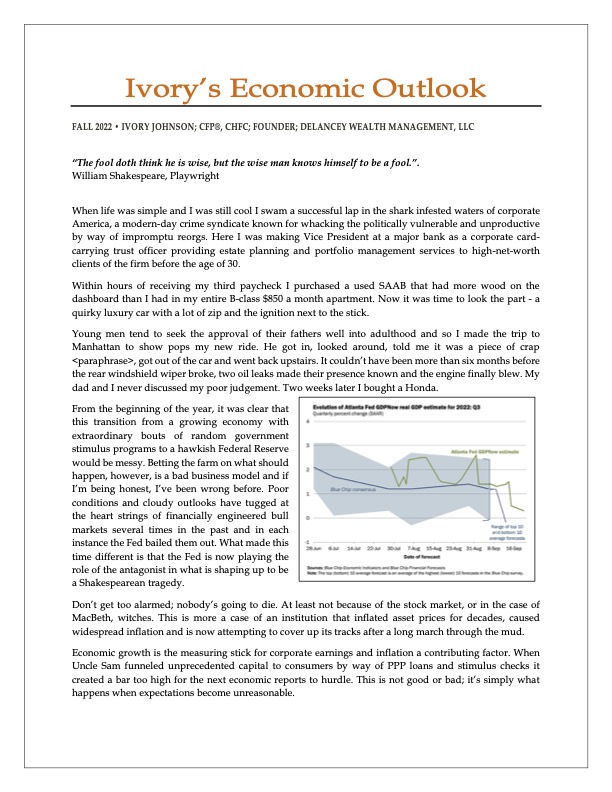

Don’t get too alarmed; nobody’s going to die. At least not because of the stock market, or in the case of MacBeth, witches. This is more a case of an institution that inflated asset prices for decades, caused widespread inflation and is now attempting to cover up its tracks after a long march through the mud.

SOMETIMES YOU HAVE TO PLAY A LONG TIME TO BE ABLE TO PLAY LIKE YOURSELF

– Miles Davis, Musician (Spring 2022 Newsletter)

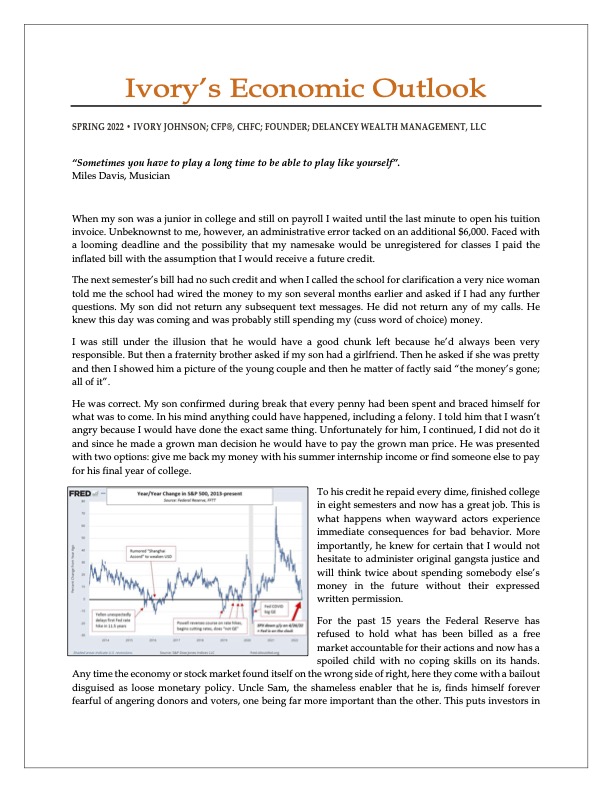

The Fed is reversing years of financial engineering and stock market coddling at the worst possible time for stocks – when the economy and inflation are both decelerating at the same time.

IF WE HAD NO WINTER, THE SPRING WOULD NOT BE SO PLEASANT

– Anne Bradstreet, Poet (Winter 2022 Newsletter)

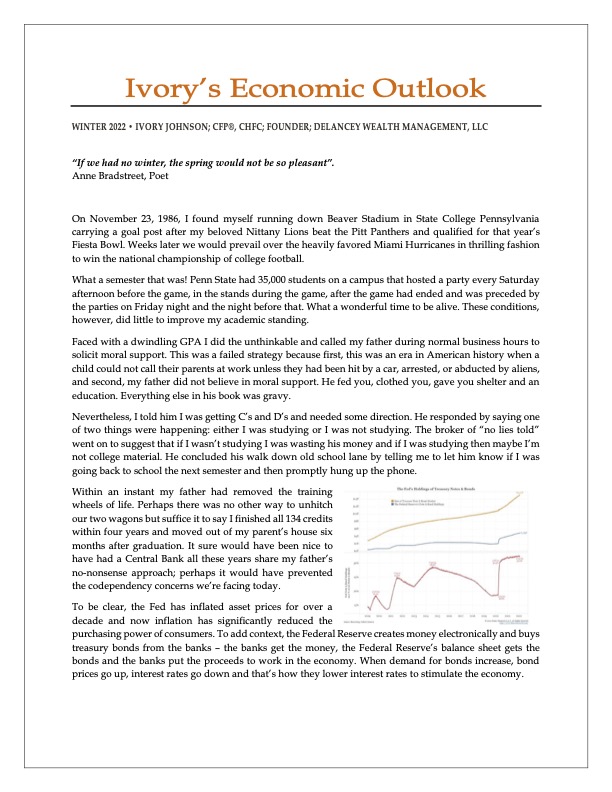

Manufactured money has caused inflation and since Main Street votes and Wall Street has better lobbyists the Federal Reserve is trying to thread a needle as narrow as gun barrels to thwart rising prices.

DOCTORS THINK A LOT OF PATIENTS ARE CURED WHO HAVE SIMPLY QUIT IN DISGUST

– Herbert Hoover (Fall 2021 Newsletter)

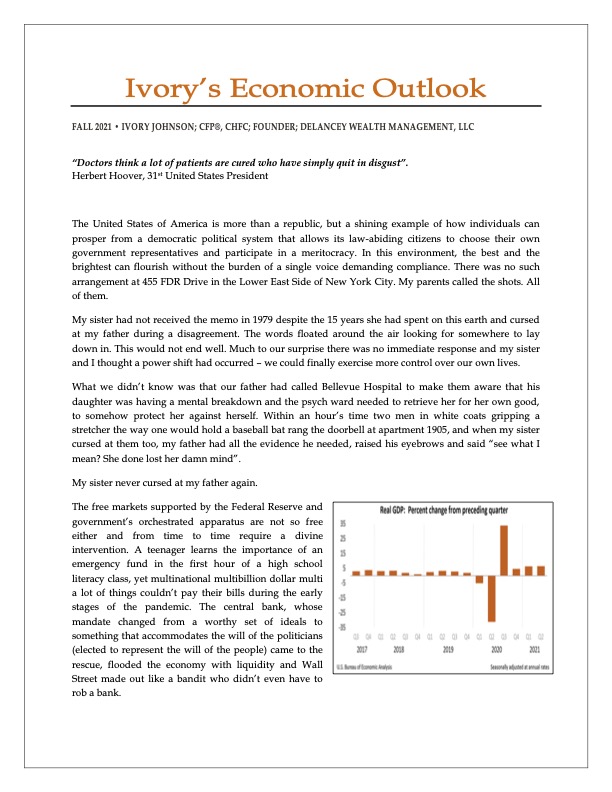

The central bank, whose mandate changed from a worthy set of ideals to something that accommodates the will of the politicians (elected to represent the will of the people) came to the rescue, flooded the economy with liquidity and Wall Street made out like a bandit who didn’t even have to rob a bank.

A PERFECTLY STRAIGHT SHOT WITH A BIG CLUB IS A FLUKE

– Jack Nicklaus, 18-time major golf tournament champion (Spring 2021 Newsletter)

My father’s Mercedes was so old that it had reached “and something” status, which is to say his car had 300 “and something” thousand miles before he was finally convinced to buy another vehicle. He ended up getting a 2010 E Class with all the bells and whistles when a steering wheel, four tires and a radio would have sufficed. When I asked him how he liked his new car he said it had everything but another woman. Then he asked me not to tell my mother what he just said.

LIFE IS LIKE BEING AT THE DENTIST. YOU ALWAYS THINK THAT THE WORST IS STILL TO COME, AND YET IT IS ALREADY OVER?

– (Winter 2021 Newsletter)

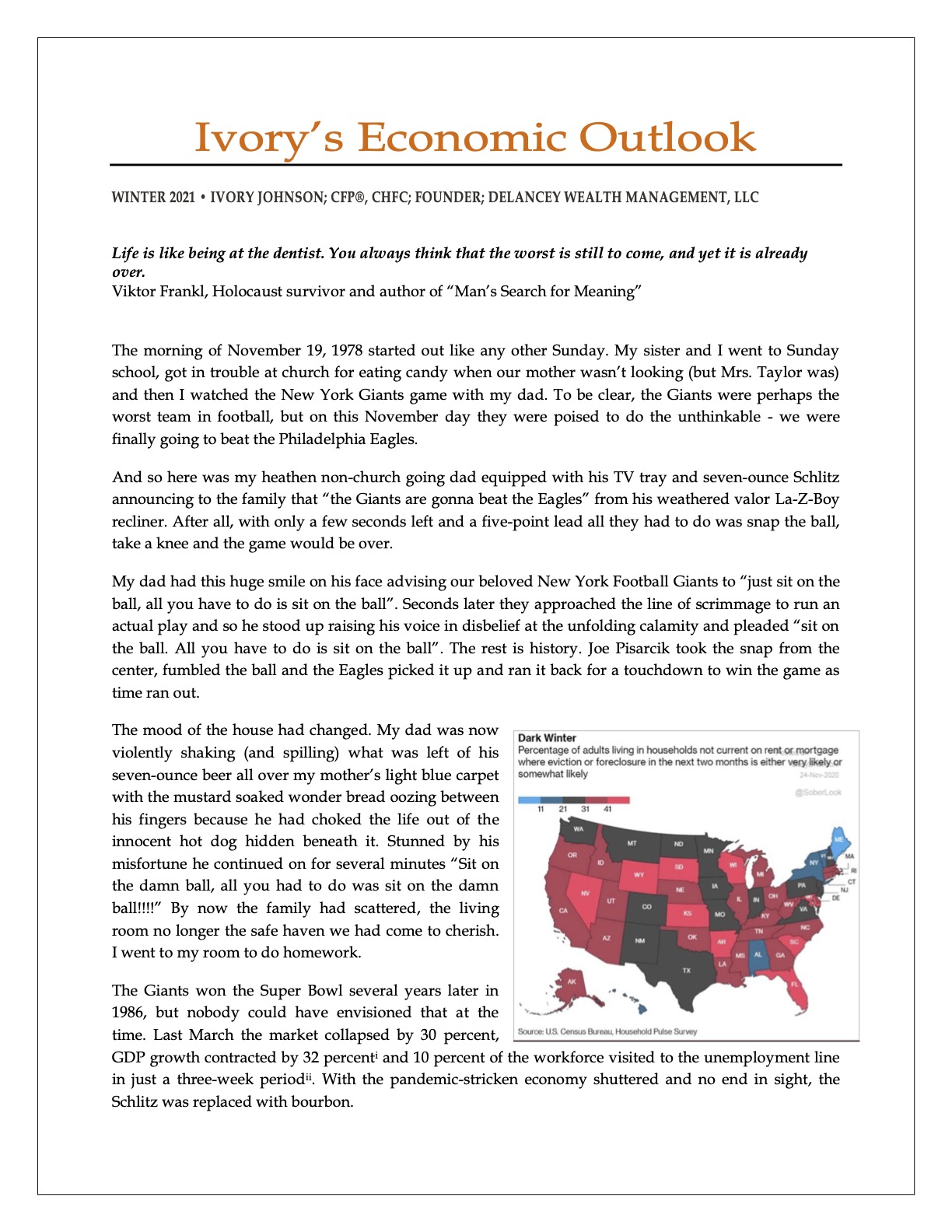

It seems the Federal Reserve spent $3 trillion fixing the stock market and not the economy. To offer a sense of how responsive the central bank has been, it’s been estimated that 20 percent of all currency in circulation today was created just last year.

THE TRUTH IS, I’VE NEVER FOOLED ANYONE. I’VE LET MEN SOMETIMES FOOL THEMSELVES?

– (Fall 2020 Newsletter)

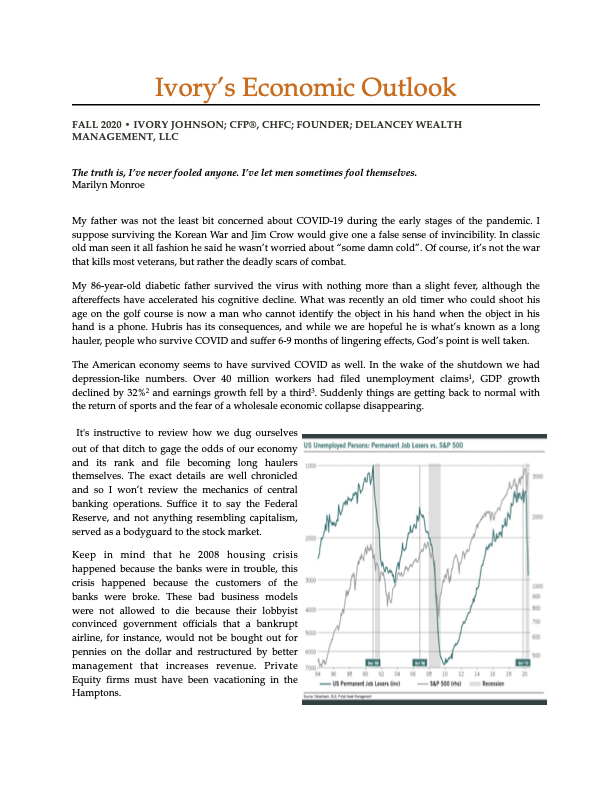

My father was not the least bit concerned about COVID-19 during the early stages of the pandemic. I suppose surviving the Korean War and Jim Crow would give one a false sense of invincibility. In classic old man seen it all fashion he said he wasn’t worried about “some damn cold”. Of course, it’s not the war that kills most veterans, but rather the deadly scars of combat.

WHO COULD BLAME ME IF I WERE IN THE BUSINESS OF PREDICTING ANIMAL BEHAVIOR AND BET A LARGE SUM OF MONEY THAT A LIMPING ZEBRA WOULD BE EATEN BY A PRIDE OF APPROACHING LIONS?

– (Summer 2020 Newsletter)

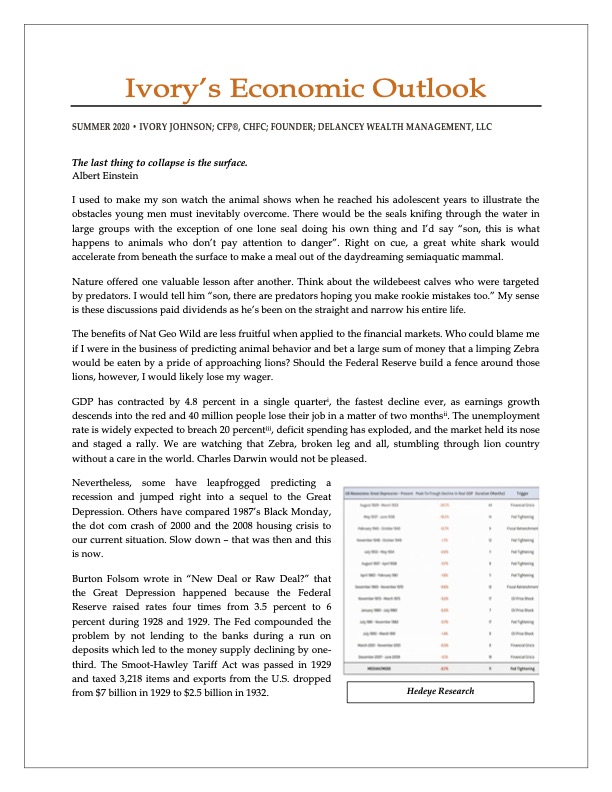

This is no time to place a large wager on or against hastily constructed fences or the immediate demise of a Zebra who can’t outrun his predators, not when hungry lions and the Fed both have impressive track records.

THE CORONAVIRUS WAS THOUGHT TO BE A SPEED BUMP, AND MAYBE THAT’S WHAT IT WILL BECOME.

– (Winter 2020 Newsletter)

Economic growth has been weaving its way lower, snaking and hissing through indigenous rhetoric and central banking pep talks from around the globe – everybody’s on board. The engine of commerce is impervious to the gravity-stricken earnings numbers, that while beating expectations, are not improving on a rate of change basis.

THE VICTORY IS NOT CHOOSING ONE OPTION OVER ANOTHER, BUT DOING SO BASED ON A REPEATABLE PROCESS.

– (Fall 2019 Newsletter)

The market, much like a man who lost his hair far earlier than he expected, isn’t quite sure what to make of it all. While 75 percent of the S&P 500 companies that have reported topped analyst expectations, a third of the companies issued lower earnings guidance.